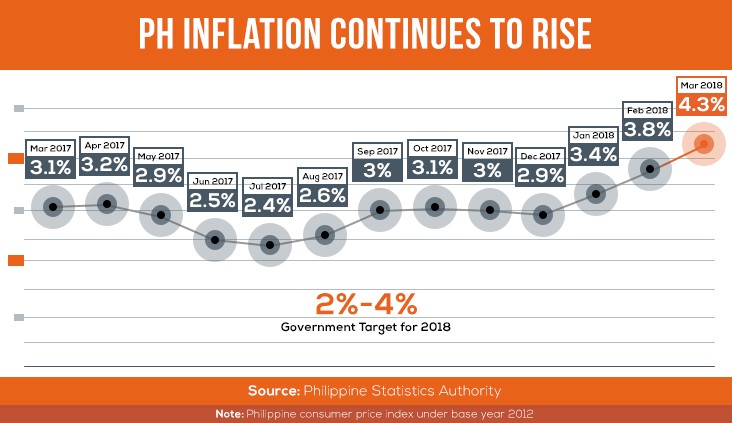

MANILA, Philippines – Inflation, or the movement of prices of basic goods and services, continued to rise to 4.3% in March, as the tax reform law jacked up the costs of food and oil in the country.

The Philippine Statistics Authority (PSA) on Thursday, April 5, reported inflation rising to 4.3% in March, from the revised 3.8% in February.

The PSA only provided inflation data using the 2012 series starting January 2013.

Using base year 2012, inflation in the 1st quarter averaged 3.8%, closer to the higher end of the 2% to 4% target set by the Bangko Sentral ng Pilipinas (BSP) for 2018. (READ: EXPLAINER: How the tax reform law affects Filipino consumers)

The PSA has rebased the inflation index to 2012 prices, from the previous series using the 2006 prices, as part of the protocol of statistical rebasing regularly done every 6 years.

Higher annual rates were noted in the food and non-alcohol beverages; alcoholic beverages and tobacco; housing, water electricity gas, and other fuels; furnishing, household equipment, and routine maintenance of the house; health; communication; as well as restaurant and miscellaneous goods and services.

PSA data showed that the movement of food prices surged to 5.7% in March, from 4.8% in February. Higher price increases were noted in rice, corn, fish, fruits, and vegetables.

Using 2006 base year

Based on the old series using the 2006 base year, inflation leapt to 4.8% in March, from 4.5% in February.

Monetary authorities would "carefully evaluate the appropriateness of a measured policy response to firmly anchor inflation expectations in line with our forecast that inflation targets will continue to be met in 2018 and 2019," BSP Governor Nestor Espenilla told reporters.

Despite the risks brought about by the new tax reform law, BSP kept the interest rates unchange, as the central bank is optimistic inflation would ease starting the last quarter of 2018.

The BSP last raised interest rates by 25 basis points in September 2014.

The central bank said it expects inflation to continue rising until the 3rd quarter of 2018.

Republic Act 10963 or the Tax Reform for Acceleration and Inclusion (TRAIN) law was implemented on January 1, 2018 , slashing personal income tax rates but raising excise tax on fuel products, motor vehicles, and sweetened beverages. – Rappler.com