MANILA, Philippines – The net income of Ayala-led Integrated Micro-Electronics Incorporated (IMI) rose in 2017 as it continued an international acquisition spree.

In a disclosure to the Philippine Stock Exchange (PSE) on Wednesday, February 7, IMI reported a net income of $34 million for full-year 2017, up 21% year-on-year.

The manufacturer's revenue was also up by 29% in 2017 to $1.09 billion.

IMI's revenue from Europe operations grew 14% year-on-year to $276.5 million on lighting, controllers, and driver assistance systems of its automotive segment. Its revenue from its Mexico operations also rose by 29% to $84.2 million.

Its China operations, meanwhile, brought in revenue of $271.1 million, up 4% from 2016, which it noted was despite the delay in new technology rollout in the telecom infrastructure business.

IMI's revenue from local operations was also up by 4% to $263.7 million, driven by new industrial applications and its automotive camera business which it said offset weaker demand in the security and medical device segments.

"We're eager to build on this success and continue to ensure that our diverse capability as an organization will sustain our competitive advantage and stronghold in the global market," said IMI chief executive officer Arthur Tan in a statement.

"As a cohesive global company with a shared vision, we aim to design competitive positions and strategies that capitalize on corporate strengths," he added.

New units contributing

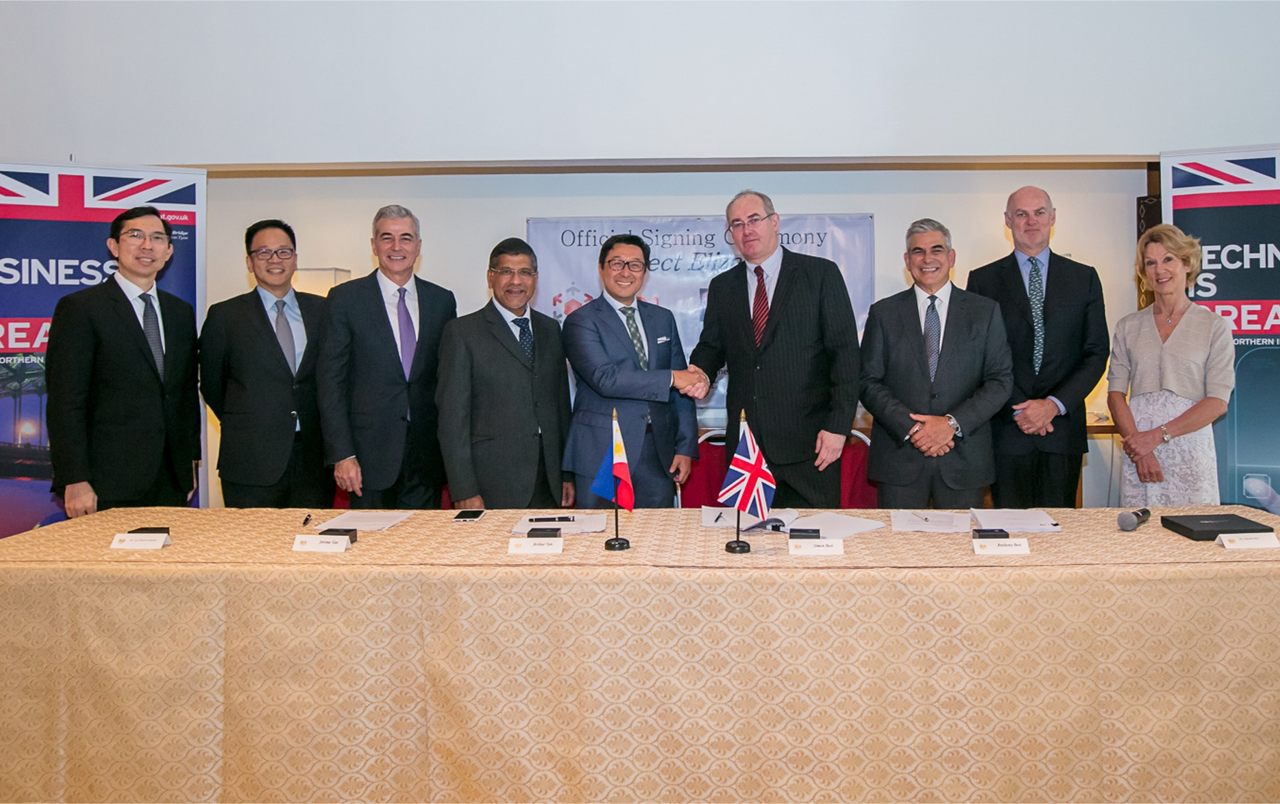

IMI made two big acquisitions in 2017, taking majority control of both German automotive parts maker MT Misslbeck Technologies GmbH in June and British defense electronics firm STI Enterprises Limited in April.

This followed the acquisition of German display solutions provider VIA Optronics GmbH in August 2016.

IMI said STI and VIA Optronics combined accounted for $193.9 million in revenue in 2017.

VIA Optronics took in $148.4 million in its first full year as part of IMI, while STI contributed $45.5 million in 7 months.

For 2017, IMI reported that it spent $65.3 million in capital expenditures while its capital structure ratio stands at 1.28 to 1 with a debt-to-equity ratio of 1.08 to 1. – Rappler.com